Content

- gold winners of the tri-cities best accounting firm award!

- Compare the top outsourced accounting service features

- Does having in-house bookkeeping allow you to offer other services such as payroll or accounts receivable management?

- You Gain Access to More Advanced Bookkeeping Equipment

- Outsourced Accounting & Bookkeeping

Our outsourced bookkeeping services are focused at reducing the finance and accounting costs of our clients by helping them with their management, accounting, and tax preparation needs. Our personalized and professional online accounting services cover the entire scope of bookkeeping and customers have the flexibility to choose what they require. We function just as customers’ virtual back office for all their bookkeeping and accounting work right from set-up, support, maintenance and consultancy. Merritt doesn’t offer many of the online accounting services that our other favorite virtual bookkeepers do, like payroll management, invoicing, or tax filing. But it provides enough outsourced accounting services to free up valuable time. Outsourced bookkeeping services comprise of a third-party company providing staff with accounting and bookkeeping knowledge. They handle financial transactions, track cash flow, manage accounts receivable/payable tasks, reconcile bank accounts, make financial reports, and prepare tasks.

What are the three types of bookkeeping?

A business must use three separate types of accounting to track its income and expenses most efficiently. These include cost, managerial, and financial accounting, each of which we explore below.

When you choose to outsource your bookkeeping, there are a few steps to take to get the ball rolling. That’s why it’s important to do your research, read online reviews, and ask friends what services they use.

gold winners of the tri-cities best accounting firm award!

Whether you’re offering products or services, sometimes administrative and accounting tasks can become tedious and time-consuming. Outsourced bookkeeping services provide an option that small businesses can turn to when they require help with managing their finances. Businesses like yours have several options when it comes to bookkeeping. You can hire outsourced bookkeeping services an in-house bookkeeper, use bookkeeping and accounting software, or outsource your bookkeeping. Outsourcing makes sense when it offers your business a cost-effective and flexible approach to accounting. You can bring down the costs even further by working with a service provider that uses cloud-based accounting software in synching bookkeeping data.

- If you’re running a small business, it’s hard to focus on marketing, quality, customer relations, vendors, and accounting.

- A freelance bookkeeper will be the most affordable option for outsourcing your bookkeeping.

- An outsourced bookkeeper tracks your day-to-day business operations and takes care of essential financial statements and reports.

- Irvine Bookkeeping is one of the dedicated outsourced bookkeeping services for small businesses that’s received many 5-star reviews from small business owners.

- Private businesses of all sizes can benefit from outsourced bookkeeping services.

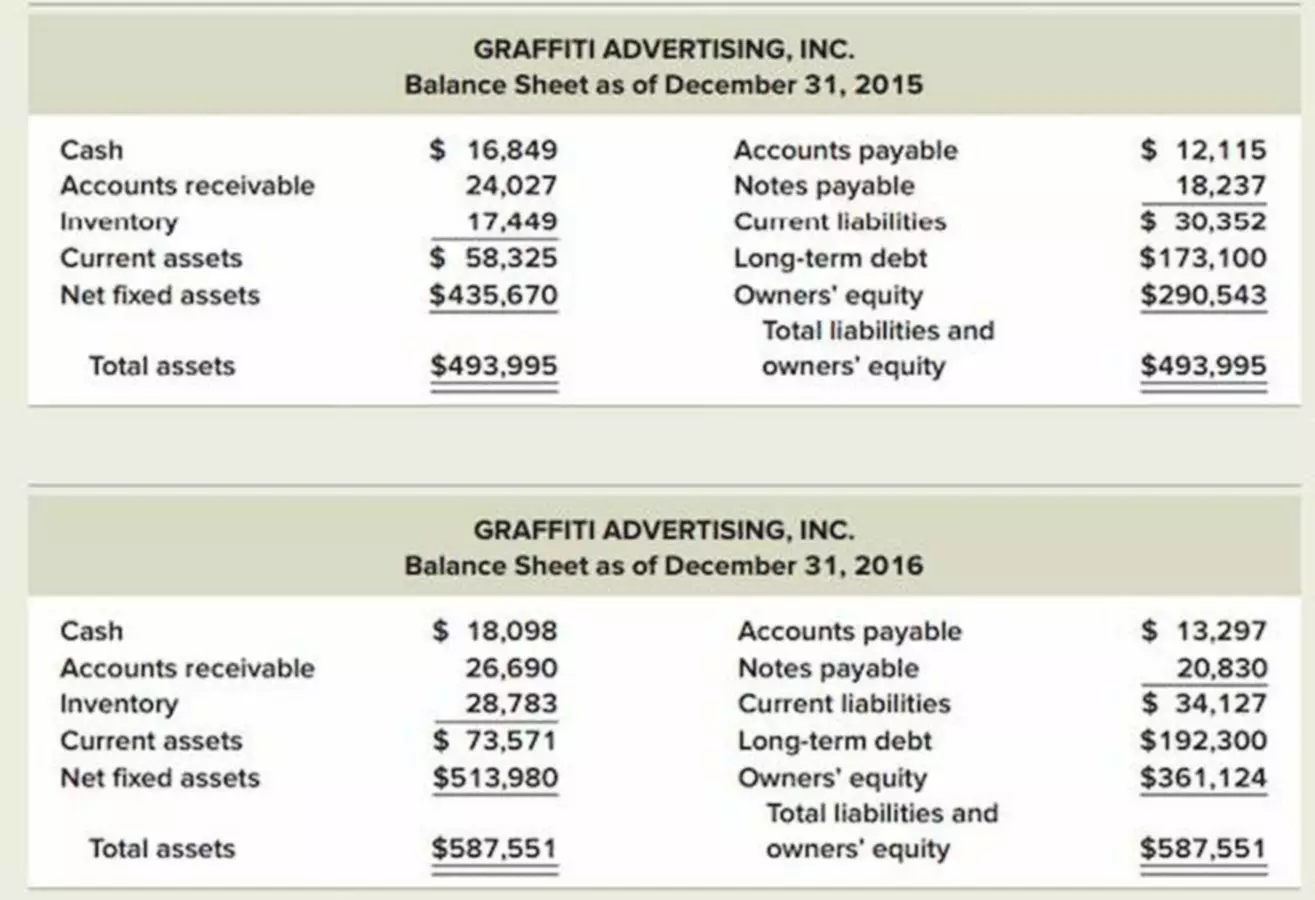

- Bookkeepers can provide you with financial reports and statements like balance sheets, cash flow statements, and income reports.

- From the outset, you need to determine whether your team can handle the time-intense job of bookkeeping.

Businessmen by trade, adventurers at heart; we understand the difficulties of running a small business and balancing a fulfilling life outside of work. This website is for information purposes only and is not intended to provide financial, accounting, or legal advice. Bookkeepers are responsible for recording financial transactions into a ledger or an accounting software to keep them organized and up-to-date. A part-time bookkeeper’s contract specifies the hours they will spend on your account; outside of these times, they probably have other clients.

Compare the top outsourced accounting service features

Industry experience can help reduce avoidable errors, but diverse expertise can also give bookkeepers insight they might not otherwise have. Some firms that handle bookkeeping also might provide tax services so that you could have it all under one roof. If they don’t, they’ll undoubtedly have experience working directly with accountants and can give you a referral for an accountant they can vouch for. Cloud-based accounting software allows bookkeeping firms to work remotely, avoiding travel time and, ultimately, reducing the overall cost of bookkeeping to their clients. Bookkeeping firms have had to hone in and build a reliable workflow to work remotely with multiple clients. You might find that their process and workflow is something you’ll need to adapt to. A freelance bookkeeper will be the most affordable option for outsourcing your bookkeeping.

But, you won’t be able to check in on your bookkeeper as you would your other employees. EAs know all of the inner tax workings of whatever state you’re operating out of, as well as what the federal government is looking for. They can help by providing tax forms like 1099s to any independent contractors you hire. That’s why so many companies, from startups to mid-sized to large enterprises, outsource this kind of work. We make it easy to get a clear picture of your finances—both where they are today and where they need to go.

Does having in-house bookkeeping allow you to offer other services such as payroll or accounts receivable management?

Plus, having an outsourced bookkeeper is more cost-efficient in the first place, since you’re not technically their employer. You won’t have to worry about their insurance, benefits, or training. Outsourced bookkeeping streamlines the financial management process and is much more efficient than traditional in-house bookkeeping. Doing the bookkeeping yourself is a time-consuming task, time that you most likely don’t have as a business owner. When you outsource bookkeeping, you will save valuable time that can be put back into improving your business in other ways. Without management accounting, business owners run the risk of making reactionary – rather than strategic – decisions. Consequently, the company’s finances are always a step behind, cash flow shortages loom around every corner and the company will perpetually be at risk of failure.

There are a lot of moving parts involved in financial management, and the IRS can be ruthless. You’ll also be able to discuss alternative services the company may be able to offer you. From there, a team of accountants and bookkeepers will work together, using the right software, to record and track all of your business spending and earnings.

You Gain Access to More Advanced Bookkeeping Equipment

Offshore Staffing Offshore staffing has a bevy of benefits, not least the potential for up to 70% cost savings. Reduce Cost Reduce costs and increase profits without compromise. 12 real-life examples of businesses who have benefited from outsourcing to emerge stronger than ever. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

- An accountant will review the reports that a bookkeeper provides to help you make important financial decisions.

- A provider is on the ground in your offshore location with a full understanding of the local market and culture, plus they operate from a central office where your staff member will be based.

- From there, bookkeeping services can be provided through any accounting system based on your conversation with the freelancer.

- Your bookkeeper organizes and verifies this data to account for all transactions.

- Whether you’re a small or growing business, you can benefit from FreshBooks’ top features without breaking the bank.

- EAs know all of the inner tax workings of whatever state you’re operating out of, as well as what the federal government is looking for.

Having both payroll processing and bookkeeping provided by a single company is convenient. With a large team of bookkeepers available, there is always someone available to assist you with your accounting questions. The flat-rate pricing for Pilot starts at $400/month putting this out of reach for many small businesses. All outsourcing companies have unique qualities but differ in many ways. It’s best to create a pros and cons list of companies when outsourcing bookkeeping so you’ll know you’ve made the best choice.

Outsourced Accounting & Bookkeeping

Costs and fee structure can also vary greatly depending on their experience and level of involvement in your accounting workflows. Many accountants or CPAs will clean up your books at the end of the year but can charge higher rates to do so. By hiring an outsourced bookkeeper you ensure accurate books at a lower cost throughout the year. By managing task allocations and providing regular feedback to your bookkeeper, you’ll be in touch with how they’re performing and fitting in with your business.

10 Tips to Guarantee a Successful Relationship With Your Part-Time Bookkeeper – Small Business Trends

10 Tips to Guarantee a Successful Relationship With Your Part-Time Bookkeeper.

Posted: Tue, 13 Dec 2022 12:30:11 GMT [source]